401(k) for SMB Retirement Plan Service SIMPLE 401(k) Plan

What is it?

As a small business owner, you're probably interested in finding ways to save for retirement. You may also be concerned about attracting and retaining qualified employees. You may be able to pursue both of these goals by establishing a savings incentive match plan for employees (SIMPLE) 401(k) plan. A SIMPLE 401(k) is a retirement plan for certain self-employed persons and small businesses. To qualify, you can't maintain another employer-sponsored retirement plan and must have no more than 100 employees who were employed in the past year and who earned at least $5,000. A SIMPLE 401(k) plan is structured as a 401(k) cash or deferred arrangement. The SIMPLE 401(k) plan was created in conjunction with the SIMPLE IRA, so these plans share certain characteristics.

Except as described below, SIMPLE 401(k) plans are generally subject to the same rules that apply to traditional 401(k) plans.

Click a topic to learn more:

|

The SIMPLE 401(k) allows eligible employees — including self-employed individuals — to defer up to $14,000 of their wages to the plan in 2022 (up from $13,500 in 2021). In addition, employees age 50 and older may contribute an additional $3,000 pre-tax in 2022 (unchanged from 2021). All employees who are age 21 or older and have completed one year of service with the employer must be eligible to participate in the plan. |

|

As an employer, you must make either a matching contribution or a nonelective contribution every year. A matching contribution must match the amount that each employee contributes up to a maximum of 3% of the employee's annual compensation. Because the maximum employee deferral for 2022 is $14,000 ($17,000 if age 50 or older), your maximum employer matching contribution for an employee is effectively the lesser of $14,000 ($17,000 if age 50 or older) or 3% of the employee's compensation. If you choose instead to make a nonelective contribution, you must contribute 2% of each employee's annual compensation whether or not the eligible employee chooses to contribute to the plan. No other employer contributions to the SIMPLE 401(k) plan are permitted. The compensation on which both the 2% nonelective contributions and the 3% matching contributions are made may not exceed $305,000 in 2022 (up from $290,000 in 2021). |

|

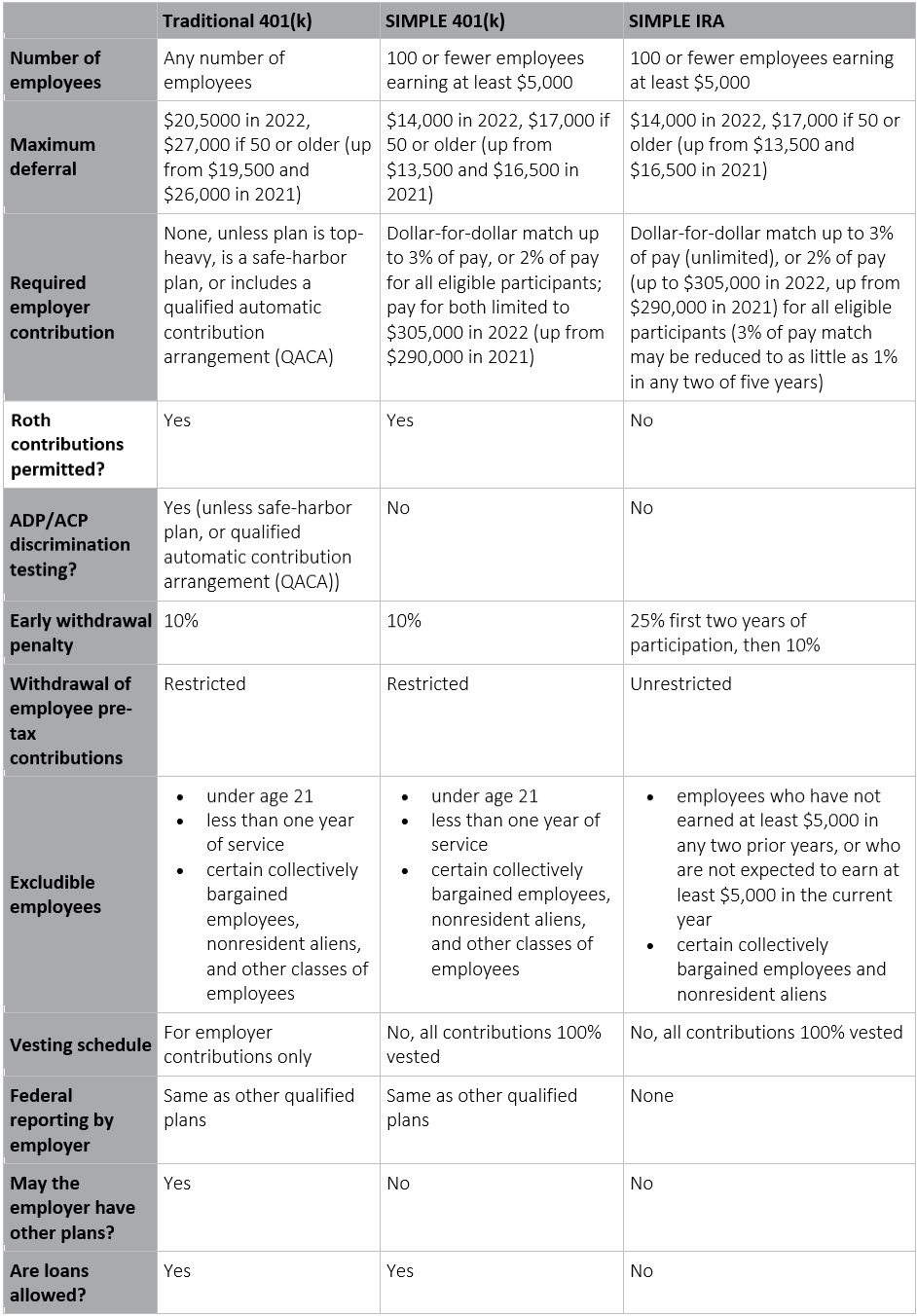

Despite the similarities the SIMPLE 401(k) shares with the SIMPLE IRA, there are significant differences between these two retirement vehicles. In particular, the SIMPLE 401(k) is more difficult to administer than the SIMPLE IRA and offers less flexibility. The following table shows some of the differences between traditional 401(k) plans, SIMPLE 401(k) plans, and SIMPLE IRAs. TableComparison of traditional 401(k)s, SIMPLE 401(k)s, and SIMPLE IRAs:

|

Who can establish a SIMPLE 401(k) plan?

You can establish a SIMPLE 401(k) plan if you're self-employed or have a qualified small business, but only if you don't maintain another employer-sponsored retirement plan.

|

If you're self-employed, without employees, you can set up a SIMPLE 401(k) plan for yourself and make contributions to the plan. You're considered to be self-employed if you're a sole proprietor or are otherwise in business for yourself. Self-employment income can also involve part-time work. |

|

You may also set up a SIMPLE 401(k) if you have 100 or fewer employees who were employed at any time in the past year and who earned at least $5,000. The number of employees is figured on an aggregate calendar-year basis, rather than on an average daily basis. For example, say you employed 97 employees earning over $5,000 in January. Two months later, seven employees left and were replaced by seven other employees receiving over $5,000. You would not qualify as a small employer. That's because you would have employed a total of 104 employees during the year. See Questions & Answers below for more information about the 100-employee limit. The term "employer" includes corporations, partnerships, sole proprietorships, and other trades or businesses under common control (whether incorporated or not). For example, if you operate both a computer rental agency and a computer repair business as sole proprietorships, the employees from both businesses would be counted together to determine if you have more than 100 employees. A tax-exempt employer may adopt a SIMPLE 401(k) plan if it meets the 100-employee test described above. Government employers generally can't have SIMPLE 401(k) plans, but can adopt SIMPLE IRA plans. |

|

You may not set up a SIMPLE 401(k) if you maintain, during any part of the calendar year, any other employer-sponsored retirement plan [such as a 401(k) plan, a tax-sheltered annuity, or a simplified employee pension plan] that benefits any of your employees eligible to participate in the SIMPLE 401(k). |

What are some advantages of establishing a SIMPLE 401(k)?

|

As long as you follow the vesting and SIMPLE plan requirements, your plan is assumed to have met the complicated rules under the Internal Revenue Code that prohibit discrimination in favor of highly compensated employees. |

|

The dollars invested in the plan are pre-tax dollars and grow tax deferred. That means that your employees can exclude the contributions from their gross income. |

|

Your business can deduct its matching or nonelective contributions to employees for the calendar year in which they are made. |

|

Participant loans are permitted in accordance with the rules governing traditional 401(k) plans. This is in contrast to SIMPLE IRAs, which do not permit loans. |

|

Funds held in a SIMPLE 401(k) plan are fully shielded from your employee's creditors under federal law in the event of the employee's bankruptcy. If your SIMPLE 401(k) plan is covered by the Employee Retirement Income Security Act of 1974 (ERISA), plan assets are also fully protected under federal law from the claims of both your employees and your creditors, even outside of bankruptcy (some exceptions apply — for example, qualified domestic relations orders and IRS liens). If your plan covers only you, or you and your spouse, ERISA will generally not apply to your plan. In this case, whether or not plan assets are protected outside of bankruptcy depends on the laws of your state. Consult a professional if asset protection is important to you. |

|

Unlike SIMPLE IRA plans, SIMPLE 401(k) plan can permit Roth contributions. |

What are some drawbacks of establishing a SIMPLE 401(k) plans

|

One of the more favorable aspects of the SIMPLE IRA is the lack of reporting and disclosure requirements. In contrast, the SIMPLE 401(k) has the same reporting and disclosure requirements of a regular 401(k). That can be time-consuming and cumbersome for an employer. |

|

Even if your business is doing poorly in a given year, you must make an employer contribution (either matching or nonelective) to the plan. In addition, you don't have much flexibility regarding the amount of your contribution. You must contribute either the 2% nonelective contribution or the 3% match. If the 3% match option is chosen, you don't have the flexibility to reduce the match in some years to less than 3% (the SIMPLE IRA allows a reduced match in any two of five years). |

|

Your employees don't have to be employed for a certain number of years in order to have full ownership of your contributions. In other words, employees are 100% vested in all plan contributions and investment earnings. Conversely, with a regular 401(k), you can require employees to remain employed for a certain period of time before they are vested in employer contributions. The SIMPLE 401(k) might not be a good choice if your goal is to induce employees to remain with your company. Furthermore, immediate vesting can be costly if you have high turnover. |

|

The SIMPLE 401(k) annual contribution limit is $14,000 in 2022 (up from $13,500 in 2021) or $17,000 if age 50 or older. That's significantly lower than the annual contribution limit for a regular 401(k), which is $20,500 in 2022 (up from $19,500 in 2021), or $27,000 if age 50 or older. Therefore, highly compensated employees and business owners who are hoping to save considerable money for retirement may prefer a regular 401(k). An employee who has several jobs with different employers and participates in several plans can't make total elective deferrals in excess of $20,500 in 2022 (plus allowable catch-up contributions). Elective deferrals to 401(k) plans, 403(b) plans, SIMPLEs, and SAR-SEPs are included in this overall limit, but deferrals to Section 457(b) plans are not. |

|

You can't maintain a SIMPLE 401(k) plan if, during any part of the calendar year, you maintain any other employer-sponsored retirement plan that benefits employees eligible to participate in the SIMPLE 401(k). Consequently, the SIMPLE 401(k) plan will not be appropriate if you want to maintain two or more retirement plans, or if you have groups of employees with different plan needs. |

|

Before the start of your plan year, you need to give your employees a 60-day election period to determine how much of their wages, if any, they wish to defer to the plan. Consequently, you need to advise employees of the type and amount of your contribution within a reasonable period of time before the 60-day election period. This generally means that you need to communicate with your employees at least 61 days before the beginning of the calendar year. |

|

Distributions from a SIMPLE 401(k) are generally subject to the same distribution rules that apply to traditional 401(k) rules. So, if you make a withdrawal before age 59½ (55 in certain cases), you'll be subject to the 10% premature penalty tax (unless you meet one of the exceptions). |

How do you establish a SIMPLE 401(k) plan?

|

The IRS has provided a model amendment that can be used to modify an existing 401(k) to function as a SIMPLE 401(k). This amendment, which is available in Rev. Proc. 97-9 in Cumulative Bulletin 1997-2, may be used only for plans that have been approved by the IRS. Furthermore, your plan must operate on a calendar year basis, not a fiscal year basis. Seek assistance from a retirement plan specialist. |

|

As with other types of retirement plans, the rules governing 401(k) plans generally require the expertise of a professional in the field of qualified benefit plans. |

|

Once you have establish ed your SIMPLE 401(k) plan, you need to follow the annual reporting and disclosure requirements that govern traditional 401(k) plans. Consult a professional in the field of qualified benefit plans. |

What are the federal income tax considerations?

|

Your business can deduct matching or nonelective employer contributions for the calendar year in which they are made. If you don't use a calendar year, contributions are deductible for the tax year that includes the end of the calendar year for which contributions are made. |

|

Your matching or nonelective employer contributions and the employees' contributions are excludable by the employee for income tax purposes, and earnings on the contributions grow tax deferred. However, the employees' contributions (but not your matching or nonelective contributions) are subject to payroll taxes under the Federal Insurance Contributions Act (FICA), Federal Unemployment Tax Act (FUTA), and Railroad Retirement Act. |

|

Generally, employees are subject to the same penalties for early withdrawals from SIMPLE 401(k)s as they are for early withdrawals from traditional 401(k)s. Therefore, if you make a taxable withdrawal from your SIMPLE 401(k) before age 59½ (age 55 in certain cases), you may be subject to a 10% premature penalty tax (unless you meet an exception). |

|

If you establish a new SIMPLE 401(k) plan, you may be eligible to receive a business tax credit for 50% of the qualified start-up costs to create or maintain the plan in three tax years. The credit may be claimed for qualified costs incurred in each of the three years starting with the tax year when the plan became effective. The amount of the credit is limited in each of the three years to $500 to $5,000, depending on the number of employees. |

|

Some low- and middle-income taxpayers may claim a federal income tax credit ("Saver's Credit") for elective deferrals made to SIMPLE 401(k) plans and certain other employer-sponsored retirement plans. |

Questions & Answers

|

You have a two-year grace period after you exceed the limit. That is, you may continue to maintain the SIMPLE 401(k) plan for the two calendar years following the calendar year in which you last satisfied the 100-employee limit. Smith and Sons, an architectural firm with 58 employees, set up a SIMPLE plan for its employees in 2019. The firm grew at a very rapid rate, and in 2020, the number of employees totaled 110. As a result, the next two years (2021-2022) were considered a grace period in which the firm could continue the SIMPLE plan. During those years, the firm employed 108 employees in 2021 and 95 employees in 2022. In 2023, Smith and Sons is allowed to continue to maintain a SIMPLE plan, because in the prior year (2022), the firm employed less than 100 employees. If the failure to satisfy the 100-employee limitation is due to an acquisition, special rules may apply. |

|

All employees who are age 21 or older and have completed one year of service with the employer must be eligible to participate. You may relax these requirements as long as you do so for all employees. |

|

Compensation includes wages, tips, and other compensation that is subject to income tax withholding, plus any contributions that the employee makes to the SIMPLE plan. For self-employed persons, compensation means net earnings from self-employment before subtracting any contributions to the SIMPLE 401(k) on behalf of the self-employed individual. The compensation on which both the 2% nonelective contributions and the 3% matching contributions are made may not exceed $305,000 (in 2022, up from $290,000 in 2021). |

|

An employee may terminate participation in the salary reduction election at any time during the year. Your plan, however, may provide that an employee who terminates may not be allowed to resume participation until the next year. |