Defined Contribution Plans for Small Business

What is a defined contribution plan

A defined contribution plan is a qualified employer-sponsored retirement plan that provides each participating employee with an individual plan account earmarked for the employee. Depending on the type of defined contribution plan, plan contributions may be made by (1) only the employer (e.g., a profit-sharing plan), (2) only the employee (e.g., a nonmatching 401(k) plan), or (3) both the employer and the employee (e.g., a matching 401(k) plan).

In the case of employer contributions, the contribution amount is generally "defined" in the plan document, often in terms of a percentage of the employee's pre-tax compensation. For plans that allow employee contributions, each employee can generally decide how much to contribute (up to the employee contribution limit), and can usually change his or her contribution at certain times of the year. Like employer contributions, employee contributions are generally expressed in terms of a percentage of the employee's pre-tax compensation.

A defined contribution plan does not guarantee a certain level of benefits to an employee at retirement or separation from service. Instead, the amount of benefits paid to each participant at retirement or separation from service is the vested balance of his or her individual account. An employee's vested balance consists of (1) the employee's own contributions and related earnings, and (2) any employer contributions and related earnings that the employee has earned (i.e., become vested in) due to length of service with the employer. The dollar value of the account will depend on the total amount of money contributed and the performance of the underlying plan investments.

Click a topic to learn more:

|

A defined contribution plan is one of two major types of qualified retirement plans. [A qualified retirement plan is a plan that receives favorable federal income tax treatment and, generally, meets the requirements of the Internal Revenue Code and the Employee Retirement Income Security Act of 1974 (ERISA).] The other major type of qualified retirement plan is a defined benefit plan. Although both are types of qualified plans, there are fundamental differences between defined contribution plans and defined benefit plans:

|

|

The amount of benefits that each participating employee will receive from a defined contribution plan at retirement or separation from service depends on several factors, including:

|

|

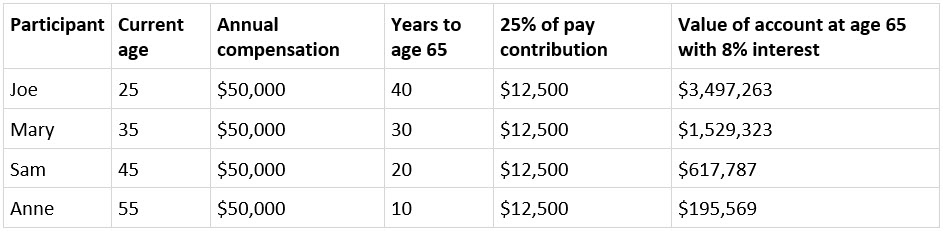

An employer that wants to benefit its young, well-paid owners and key employees will generally find a defined contribution plan most beneficial. That's because such employees typically have many years in which annual contributions can be made and invested, creating the opportunity for significant tax-deferred growth over the long term (depending on investment performance). Parrot Enterprises has four owners of varying ages. As the following table illustrates, younger employees have the potential to amass extremely large sums of retirement funds through a defined contribution plan.

The above scenario is entirely hypothetical and not to be used as a reliable indicator of future benefits under a defined contribution plan. Both annual contributions and investment returns can vary from year to year — widely, in some cases. There is even the possibility that a participant's plan account may lose value if his or her plan investments perform poorly. |

|

As an employer, the maximum annual tax-deductible contribution that you can make to a defined contribution plan is generally limited to 25% of the total compensation of all employees participating in the plan. [Employee pre-tax deferrals to a 401(k) plan are deductible separately from this 25% limit.] The specific rules regarding deductibility of employer contributions are complex, however, so you should consult a tax advisor for guidance. For 2022, annual compensation in excess of $305,000 (up from $290,000 in 2021) for any individual plan participant cannot be included in calculating the maximum annual tax-deductible contribution. |

Annual additions limitFor purposes of the annual additions limit (see below), compensation generally includes all taxable personal services income, such as wages, salaries, fees, commissions, bonuses, and tips. It does not include pension-type income, such as payments from qualified plans, nonqualified pensions, and taxable compensation due to participation in various types of stock and stock option plans. In addition, compensation includes voluntary salary deferrals to 401(k) plans and cafeteria plans. The maximum amount of annual compensation that can be used to determine the annual additions limit for any single plan participant is $305,000 (for 2022, up from $290,000 in 2021). Highly compensated employeeFor 2022, a highly compensated employee is an individual who:

For this purpose, compensation includes all taxable personal services income, such as wages, salaries, fees, commissions, bonuses, and tips. In addition, it includes elective or salary-reduction contributions to cafeteria and salary deferral plans such as 401(k) plans. |

|

Annual additions are the sum of (1) total contributions (employer and employee) made to an individual participant's plan account for the year, and (2) any forfeitures of other employees' accounts that are reallocated to the participant's plan account. The maximum annual additions that can be allocated to any individual participant's plan account are the lesser of (1) 100% of the participant's compensation for the year, or (2) $61,000 (for 2022, up from $58,000 in 2021). As mentioned, the maximum amount of annual compensation that can be used to determine the annual additions limit for any single plan participant is $305,000 (for 2022, up from $290,000 in 2021). You must treat all qualified defined contribution plans you maintain as a single plan for purposes of calculating the annual additions limit. For 401(k) plans, employees age 50 and older can make catch-up contributions of up to $6,500 in 2022 in excess of the $61,000 annual additions dollar limit. |

|

Here are brief descriptions of the major types of qualified defined contribution plans... Profit-sharing planA profit-sharing plan is a defined contribution plan that allows for employer discretion in determining the level of annual contributions to the plan. In fact, the business can contribute nothing at all in a given year if it so chooses. As the name suggests, a profit-sharing plan is usually a sharing of the employer's profits that may fluctuate from year to year. Generally, corporations will contribute to profit-sharing plans in one of two ways: either according to a written formula or in a purely discretionary manner. 401(k) planA 401(k) plan, sometimes called a cash or deferred arrangement (CODA), is a defined contribution plan in which employees elect either to receive cash payments from their employer immediately or to defer receipt of the income. If deferred, the amount deferred consists of pre-tax dollars that are invested in the employee's plan account. A 401(k) plan can also allow employees to make after-tax Roth contributions. Often, the employer matches all or part of the employees' deferrals to encourage employee participation. The 401(k) plan is the most widely used type of defined contribution plan. An individual 401(k) plan can be established that covers only a business owner, or the business owner and his or her spouse. Money purchase pension planA money purchase pension plan is a defined contribution plan in which the employer makes an annual contribution to each employee's account in the plan. The amount of the contribution is determined by a set formula that cannot be changed, regardless of whether or not the corporation is showing a profit. Typically, the business's contribution will be based on a certain percentage of an employee's compensation. Age-weighted profit-sharing planAn age-weighted profit-sharing plan is a defined contribution plan in which contributions are allocated based on the age of plan participants as well as on their compensation. This type of plan benefits older participants with fewer years until retirement by allowing them to receive much larger contributions to their accounts than younger participants. Target benefit planA target benefit plan is a hybrid of a defined benefit plan and a money purchase pension plan. It resembles a defined benefit plan in that the annual contribution is based on the amount needed to fund a specific amount of retirement benefits (the "target" benefit). It resembles a money purchase pension plan in that the actual benefit received by the participant at retirement is based on his or her individual balance. New comparability planA new comparability plan is a variation of the traditional profit-sharing plan. This type of plan is unique in that plan participants are divided into two or more classes based on their age and other factors. The new comparability plan therefore allows businesses to maximize plan contributions to higher-paid workers, key employees, and owner/employees, while minimizing contributions to the other employees. Thrift/savings planA thrift or savings plan is a defined contribution plan that is similar to a profit-sharing plan, but has features that provide for (and encourage) after-tax employee contributions to the plan. The employee must pay tax on his or her own contributions before they are invested in the plan. Typically, a thrift/savings plan supplements after-tax employee contributions with matching employer contributions. ESOP planAn ESOP plan, sometimes called a stock bonus plan, is a defined contribution plan in which participants' accounts are invested in stock of the employer corporation. This type of plan is funded solely by the employer. When a plan participant retires or leaves the company, the participant receives his or her vested balance in the form of cash or employer securities. |